THE SENKEN’s Ranking of Speciality Stores 2015

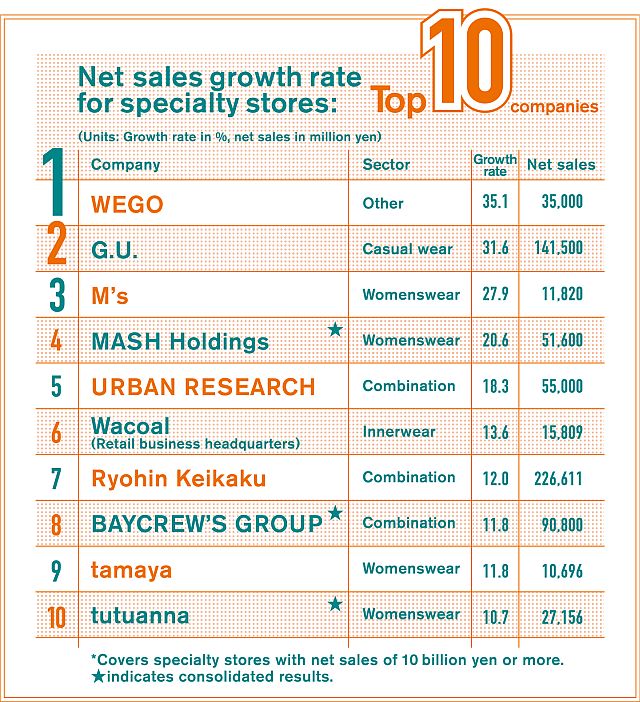

Looking at the results related to the sales growth rate of companies researched within the FY2015 Ranking of Speciality Stores, 11 out of the 20 companies surveyed with annual sales of 10 billion yen reported two-digit growth. WEGO CO., LTD. and G.U. CO., LTD. saw 30% growth, while M’s Co., Ltd. and MASH Holdings Co., Ltd. reported a 20% increase in income. Despite the continuation of the difficult climate related to the sale of fashion goods following the increase in consumption tax, regardless of the scale or category, companies that played to their own strengths experienced growth.

Among the 11 companies with double-digit sales growth, only two saw annual turnover exceeding 100 billion yen. G.U. CO., LTD. bolstered sales around projects featuring autumn/winter 2014-2015 trend goods appealing to a wide age range, and succeeded in developing hit products such as gaucho pants. Ryohin Keikaku Co., Ltd., on the other hand, increased its income not through trend products, but through the sale of daily necessities.

WEGO CO., LTD. achieved the top growth rate among all 20 companies through the enhancement of its sales policy for youth fashion. The company did not only increase its number of stores, but started offering other goods in addition to clothes, greatly increasing customer numbers even as it lowered unit prices. M’s Co., Ltd. doubled its efforts on youth fashion products at easily purchasable price points, thereby increasing its results.

Wacoal Corp. diversified business R&D for its sales projects, allowing it to create flexible stores that could maintain their positions and customers. Tutuanna Co., Ltd. enhanced its product line-up aimed at career women, offering such new items as its “Unmei no bra” (destiny bra) and “Eien no bra” (forever bra), thereby enhancing the market position of its stores. CITY HILL CO., LTD.’s efforts to share success case studies from its main brands with other brands allowed it to capture customer segments outside of the youth segment. A major source of its income growth came from placing such brands on a growth track.

Although it didn’t see double-digit growth, UNIQLO CO., LTD. achieved growth of close to 800 billion yen, allowing it to maintain a high growth rate of 9% in the survey this time as well. Adastria Co., Ltd. achieved a growth rate of 8.4% and consolidated sales of over 200 billion yen in the fiscal period ending February 2016. Both its projects and mainline brands performed well.

The 119 companies responding to the survey reported that they collectively operated 22,987 stores. This is an increase of 1,247 stores on the previous fiscal period. Although there were speciality stores among the companies with increased sales growth that achieved higher incomes thanks to the continuing vigour of their stores, regardless of the scale of the company, there are examples such as M’s Co., Ltd., CITY HILL CO., LTD., UNIQLO CO., LTD., and Adastria Co., Ltd. that increased incomes without expanding stores.

Some of these companies saw increases in EC sales contribute to their results. That said, looking solely at the results of the survey this time, it seems that more than store expansions, these companies achieved what they did through successes in projects targeting specific customer segments and efforts to increase the rates at which they put out hit products.