Optimising profit balance around a new revenue source

Major department stores are expanding their real-estate businesses as a new source of revenue. As department stores continue to struggle with their sales and profits, many are reviewing the business composition used until now which overemphasises retail sales, with the aim of optimising their profit balance. In parallel, there have recently been many cases in which companies are using real-estate know-how being to revitalise department stores.

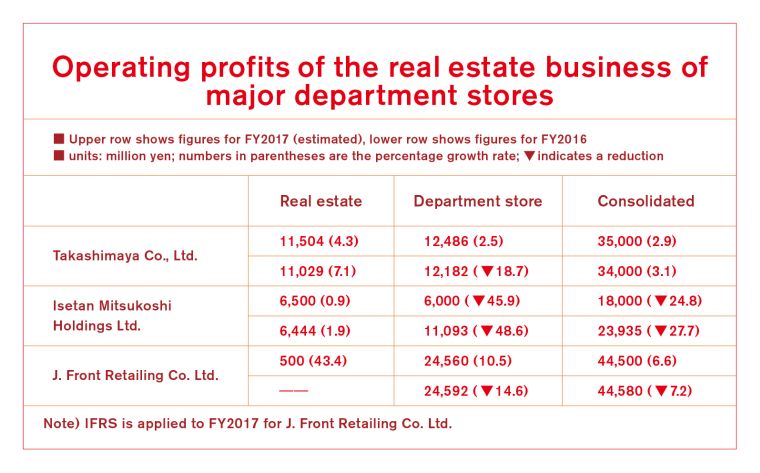

Takashimaya is leading the way in this trend. Its real-estate business already generates the same level of revenue as its department stores, particularly its subsidiary, Toshin Development. Takashimaya plans to generate 15 billion yen in operating profit from its real-estate business in fiscal year 2021, and is accelerating its operations both domestically and abroad.

Its department store business has cooperated with Toshin Development thus far in the Tamagawa Store, Shinjuku Store, Kashiwa Store and Tachikawa Store, but the renovation of the Nihonbashi Store will be the largest project Toshin Development has ever tackled. A new building (17,000m2) will open in the district adjacent to the Nihonbashi Store in the autumn of 2018, and Takashimaya seeks to create a new urban shopping centre through the department store in its main building and specialty stores in the new building.

On the other hand, the property management (real-estate operation & management) of Takashimaya Time Square, which includes the Shinjuku Store, was unified under Toshin Development in September of 2016. Real-estate projects which utilise held properties include apartment development in Edogawa Ward, Tokyo and Yokohama City, and in addition to retail, Toshin Development will renovate the Osaka Store East Annex Building and start service of a residence in 2019.

J. Front Retailing, which possesses Daimaru, Matsuzakaya and Parco, will increase the proportion of operating profit generated by its real-estate business to 12% over the next 5 years. The operating profit of the real estate business, including Parco, is expected to exceed 20 billion yen in 2021, putting it on the same level as the department stores.

After GINZA SIX in April, the real-estate business is looking towards a number of large-scale projects such as a combined commercial facility in Ueno in the autumn of 2017, and the reconstruction of the Shinsaibashi Main Building in the autumn of 2019.

J. Front Retailing is seeking to support its main building department store through combined facilities such as Parco and department stores in Ueno, and introducing specialty store tenants in its North Building in Shinsaibashi. To devote further efforts to tenant leasing and facility management operations, a real-estate business division which combines the group’s real-estate know-how was established in Daimaru Matsuzakaya Department Stores in July 2016.

J. Front Retailing will also begin development in the areas surrounding its stores. It is expanding its real-estate business through the development of its own properties in Shinsaibashi, Ueno, Nagoya, Kobe and Kyoto, and through the acquisition of external properties.

Isetan Mitsukoshi Holdings is seeking to monetise its owned real-estate in Shinjuku and Nihonbashi through effective utilisation. At the same time, in addition to its collaboration in credit cards and CRM (customer relationship management) with Nomura Real Estate Holdings through the comprehensive business tie-up it formed in October 2015, Isetan Mitsukoshi Holdings is also looking into joint ventures for apartment sales.

Overseas, both companies plan to develop combined facilities including residential lots and commercial facilities in Manila in the Philippines, and will launch the commercial facility portion in 2020.

In any case, activities will focus on expanding the leased surface area through the redevelopment of owned real-estate in prime urban areas, and company and external properties in the areas surrounding stores. Companies are seeking to leverage the real-estate business to not only contribute to revenue, but also instigate structural reform for department stores, such as enhancing their revenue structure.

Companies will have trouble overcoming the current difficult environment using the conventional department store model, including that used for regional and suburban locations. Companies are accelerating structural reforms for survival, not only cutting expenses by reducing headcount and land rents, but also converting certain business lines, such as introducing tenants through loan contracts.